The Bloody History of Rate Cycles

Every real estate boom feels like it will last forever, and every bust feels like the end of the world.

But if you zoom out, nearly every cycle follows the same pattern—driven by one factor more than anything else: interest rates.

Cheap debt fuels buying frenzies. Expensive debt kills them.

History doesn’t just suggest this—it proves it. Let’s take a walk through time and see how every major real estate cycle has been shaped by rates.

It’s particularly relevant today since the world is undergoing yet another shift in the interest rate paradigm. This shift is proving difficult, if not disastrous, for many investments made pre-2023. To quote the great Warren Buffett, this is the time to find out who was swimming without their trunks on.

The History of Rates & Real Estate Cycles

None of this should come as a surprise. Here’s a fascinating chart I dug up - see below. No industry is more cyclical and prone to boom & bust than construction (development). We’re in the midst of the bust cycle right now in this space.

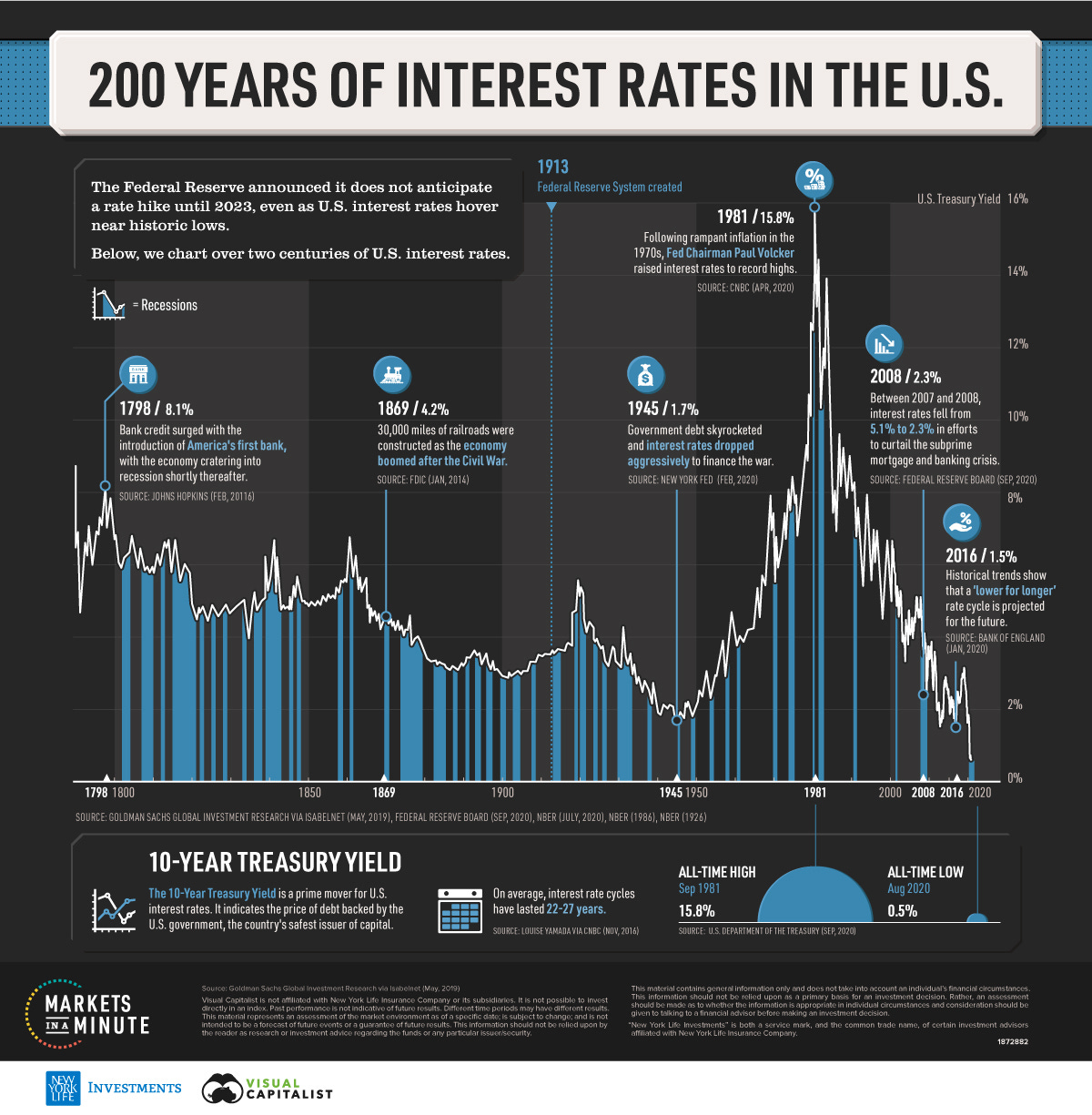

And just for fun - I’ve included this awesome chart, which shows 200 years of interest rates in the United States. The 10-year treasury today (late April) is around 4.3%. That puts us around, in my opinion, the historic median because we should discount the early 1980s rate increase period.

Let’s take a brief journey through rate decreases/increases and real estate booms and busts.

The Roaring 1920s & The Great Depression

In the aftermath of the most destructive war in human history (to that point - it’s a sad note that the 20th century actually takes the cake for two of the most destructive wars in human history), the party was on in America.

The 1920s were a golden age for real estate speculation, driven by a booming post-war economy, rapid urbanization, and—most importantly—cheap credit. Intending to fuel expansion, banks provided easy access to mortgages with loose lending standards. Florida, in particular, became the poster child of speculative excess, with investors flipping land before the ink was even dry on their contracts. Prices soared, and buyers assumed they could never lose. It was a “new era” of prosperity—or so they thought.

But when the stock market crashed in 1929, everything unraveled at once. Instead of injecting liquidity, the Federal Reserve tightened credit conditions, making refinancing impossible. As panic set in, banks collapsed, and foreclosures skyrocketed. Real estate values plummeted, often by 80% or more. The lesson? Cheap debt fuels euphoria, but asset prices collapse fast when the credit spigot turns off.

The Post-WWII Housing Boom (1950s-60s)

In contrast to the speculative excess of the 1920s, the post-World War II housing boom was a government-engineered success story. With millions of returning soldiers needing homes, the government stepped in with VA and FHA loans, offering cheap mortgages with low down payments. The Federal Reserve kept interest rates artificially low, making borrowing affordable, while suburban expansion became the defining economic force of the era. This was the birth of the modern mortgage market as we know it.

However, inflation was creeping up by the late 1960s, partly due to increased government spending on both the Vietnam War and domestic programs. The Fed, recognizing the problem, began raising rates in the late 1960s and early 1970s, which slowed down housing affordability. This was a mild correction, but it was a preview of what was to come. The lesson? Long-term housing booms are often supported by artificially low rates, but inflation eventually forces a correction.

The 1980s S&L Crisis—A Warning for Today?

The 1980s saw one of the most chaotic real estate collapses in U.S. history, and it was largely a result of financial deregulation meeting aggressive interest rate policy. The Savings & Loan (S&L) industry—small, local banks that traditionally focused on mortgages—was deregulated in the late 1970s, allowing them to take on much riskier loans. This came just as Paul Volcker, Fed Chair at the time, launched the most aggressive rate hikes in U.S. history to combat double-digit inflation. Interest rates soared, peaking at over 20% in 1981.

For real estate investors and homeowners alike, this was a disaster. People who had borrowed at low rates in the 1970s found themselves completely crushed when trying to refinance. The value of commercial real estate collapsed, and by the mid-1980s, nearly a third of all S&Ls failed—causing the largest banking collapse since the Great Depression. The lesson? Short-term debt in a rising rate environment is a financial death sentence. If you borrow cheap, you better have an exit strategy.

The 2000s Subprime Crisis & 2008 Crash

If the 1980s crisis was about banks failing due to rising rates, the 2008 collapse was about banks failing due to lending at artificially low rates for too long. The early 2000s were defined by cheap mortgage credit, as the Federal Reserve slashed rates to stimulate growth after the dot-com bust and 9/11 attacks. Housing prices skyrocketed as exotic mortgage products—zero-down, interest-only, and subprime loans—became the norm. Anyone with a pulse could get a mortgage.

But in 2006-07, the Fed started hiking rates to cool inflation. Suddenly, all those adjustable-rate mortgages reset to higher payments. Homeowners who had leveraged up based on teaser rates couldn’t afford their payments, leading to mass foreclosures, a banking collapse, and the worst financial crisis since the Great Depression. The lesson? Artificially low rates create bubbles, and when the Fed reverses course, over-leveraged investors always get wiped out.

The 2010-2021 “Zero Interest Rate” Boom

After the bloodbath of 2008, the Federal Reserve took unprecedented action—slashing interest rates to nearly zero and pumping liquidity into the economy through Quantitative Easing. This created one of the longest, strongest real estate booms in history. With cheap mortgages available, housing demand soared, cap rates compressed to record lows, and asset prices inflated beyond all reason. Investors who locked in low, long-term debt during this period made a fortune.

However, the downside of zero rates was the complete distortion of risk pricing. Investors and syndicators overpaid for properties, assuming rents would rise forever. When the Fed rapidly hiked rates in 2022-23, it sent shockwaves through the industry. Many short-term bridge loans became unpayable, syndicators started defaulting, and real estate values—especially in multifamily—dropped 20-30% in some markets. The lesson? When rates are at zero, everyone’s a genius. But if you’re not stress-testing your deals for a high-rate world, you’re taking hidden risks that can be catastrophic.

Today’s Market (2024-2025): What’s Next?

Right now, we’re in the middle of another Fed-driven correction. After a decade of artificially low rates, investors forgot what normal borrowing costs looked like. In some markets, property prices are still adjusting. The biggest question isn’t if rates will change again—but when and how.

Two scenarios are likely:

-

If rates stay high for longer, we could see another 1980s-style deleveraging. Investors who took on short-term debt with unrealistic rent growth projections will continue to struggle. We might see distressed sales and buying opportunities in 2024-25.

-

If the Fed cuts rates aggressively, we could see another asset bubble. Low rates could fuel another real estate buying frenzy as capital floods back into the market.

Either way, the lesson remains: real estate fortunes are built by those who understand interest rates—not just as a number but as the single biggest force shaping every boom and bust.