Tariffs - 5000 Years of History

On April 2nd, the Trump Administration slapped sweeping new tariffs on global trade. It’s being called Liberation Day, but it could just as easily be called Opportunity Day for investors. While markets panic, smart capital is already moving.

But any way you look at this—here’s the key point. We have been here before. Tariffs are certainly not a new invention. So the real question for investors of all stripes is—what is the impact? And what was the historic impact of tariffs on investment strategies here, domestically, in the United States of America.

First—in a Timeless fashion—let’s take a quick stroll through the history of tariffs.

The Ancient & Middle Ages World: Tariffs as Power Plays

As always—there is nothing new under the sun.

In Mesopotamia (circa 3000 BCE), city-states like Ur and Lagash imposed duties on goods entering their ports. The Code of Hammurabi (circa 1754 BCE) mentions taxes on trade, with penalties for evasion that’d make the IRS blush. These duties made local goods cheaper, encouraging land-based agriculture—early real estate wealth tied to fertile fields along the Euphrates. Land near trade routes became prime, as merchants needed storage and homes to support their operations.

Fast-forward to the Roman Empire. The Romans imposed the portorium on goods crossing provincial borders—typically 2.5 to 5%. Major ports like Ostia collected taxes on grain, wine, and luxury goods like silk from China. Roman emperors used the revenue to fund infrastructure—roads, aqueducts, public buildings—which drove up land values in well-connected areas. But high tariffs also hurt small farmers who couldn’t compete when duties dropped, creating distress that savvy investors like Marcus Crassus capitalized on by buying up cheap properties. Sound familiar? It should—crises have always been a real estate investor’s best friend.

In the Middle Ages, the Islamic Caliphates imposed the ushr tax—a 10% duty on goods entering or leaving Muslim lands, though non-Muslims often paid up to 20%. This funded the caliph’s treasury and projects like the House of Wisdom in Baghdad, but it also made land near the Silk Road insanely valuable. Merchants and traders built homes and warehouses along these taxed routes, driving up property values. Tariffs didn’t just raise revenue—they shaped where wealth was concentrated, turning trade hubs into real estate goldmines.

In short, even in the ancient world, tariffs generated revenue and protected local industry where needed. But they also had a sneaky side effect: they made land near trade routes the ultimate prize.

The Early Modern World: Mercantilism and the Seeds of Revolution

Let’s jump to the early modern period, where mercantilism ruled the day. Mercantilism is a nationalist economic policy designed to maximize exports and minimize imports—basically, “screw the other guy, grow your own economy” (thanks, Wikipedia, for the sanitized version).

The British Empire, at its height, is the poster child for this. “The sun never sets on the British Empire” wasn’t just a catchy phrase—it was literal. The empire spanned the globe, so in theory, mercantilist policies should’ve created a self-contained trading system that functioned like a globalist dream. Spoiler: it didn’t. The Navigation Acts (1651-1696) slapped heavy duties on foreign goods entering British ports—up to 30% on French wine, for example. The goal was to keep trade within the empire and grow domestic industry, but it backfired. Smuggling exploded, and colonial tensions boiled over. Land in port cities like Bristol and Liverpool became valuable for warehouses, but rural estates suffered as imported goods got pricier. Those tariffs helped spark the American Revolution—colonists weren’t too keen on being taxed into oblivion while their land values stagnated.

Mercantilism shows us tariffs can be a double-edged sword: they boost some real estate (trade hubs) while hurting others (rural areas). But they also create volatility—perfect for investors who can play the long game.

The United States: Tariffs as a Political Football

Which brings us, at last, to the United States.

Tariffs have been part of the American story since day one. In 1789, the first Congress passed the Tariff Act—5% on imports to fund the new government. It was a no-brainer: we needed cash, and taxing foreign goods was the easiest way to get it. By the 19th century, tariffs were a political football.

The Tariff of 1828—nicknamed the “Tariff of Abominations” by Southerners—jacked up rates to 50% on manufactured goods. Northern industrialists loved it; Southern farmers hated it. It nearly sparked a civil war (look up the Nullification Crisis if you want a wild story). Tariffs have always been divisive—they create winners and losers, and real estate is often caught in the crossfire.

Just a quick note on this tariff because history is filled with so many fascinating things. Why did the Southerners hate it? Because the tariff was designed to protect northern industry. It increased the cost (dramatically - 50%!) on foreign manufactured goods, which meant that the Government was effectively forcing the South to have to buy from northern manufacturers. There is an entire economic backstory in the lead up to the Civil War that is fascinating.

Let’s zoom in on 1930—the Smoot-Hawley Tariff Act. This was the big one. Congress slapped tariffs on 20,000 imported goods, averaging 40%. The idea was to protect American farmers and manufacturers during the early days of the Great Depression. It backfired hard. Global trade tanked by 66%, other countries retaliated, and the Depression worsened. Housing took a beating—construction ground to a halt, home sales plummeted, and foreclosures spiked. But here’s the kicker: the smartest investors saw an opportunity. They scooped up distressed properties for pennies on the dollar, held through the chaos, and came out millionaires when the market recovered in the late 1930s. Crises always create openings for those who can stomach the heat.

Closer to home, let’s talk 2018. Trump’s first tariff wave hit steel and aluminum—25% and 10%, respectively. According to the Associated General Contractors, construction costs jumped $1 billion in a year. Builders passed those costs onto buyers, and new home prices crept up. But investors who bought existing properties—especially in supply-constrained markets like Seattle and Portland—saw rents climb as demand outstripped supply. History’s clear: tariffs shake things up, but real estate has a way of coming out on top.

Tariffs in 2025: The Good, the Bad, and the Opportunity

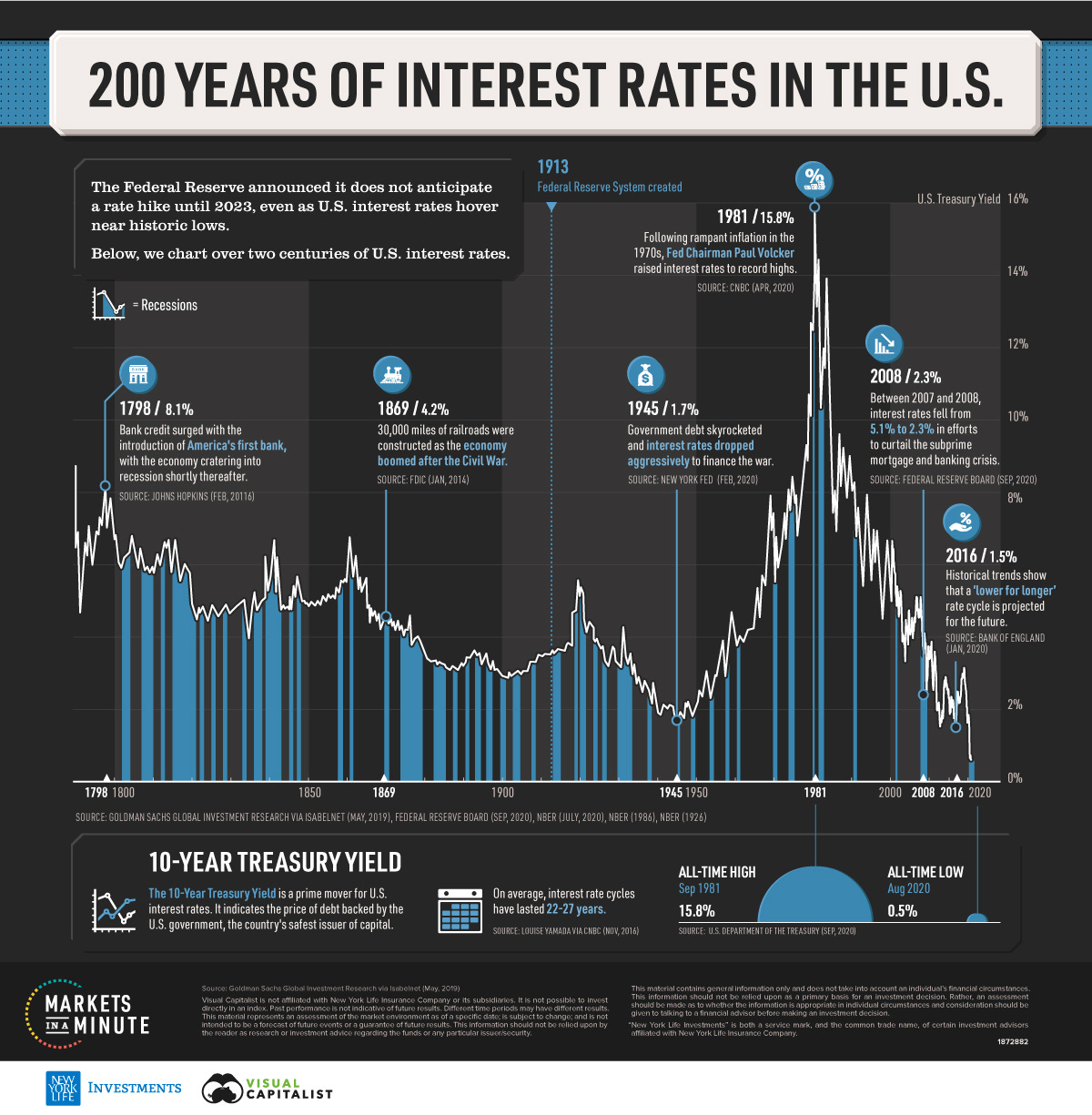

This brings us to today. The “Liberation Day” tariffs are no joke: 34% on Chinese goods, 20%+ on the EU, Japan, and India, and 10% on everybody else (except Canada and Mexico). Goldman Sachs says recession odds are up to 35%, and inflation could jump 2 points. The Fed’s in a bind—tariff-driven inflation means they can’t cut rates fast, but the 10-year Treasury yield’s down to 4.1% as markets brace for a slowdown. Meanwhile, the S&P 500’s off 5% this month, and Wall Street’s in full panic mode.

Now, the odds are that this “helps” spark a recession. It will almost certainly impact inflation—potentially by as much as two points, per Goldman Sachs. It seems self-evident that increasing the cost of foreign goods is a cost ultimately passed onto the American consumer. The argument today is that we should suffer this “short-term pain” for “long-term gain.” In this context, I “think” that long-term gain is a more self-reliant nation that domesticates more industry and builds a stronger manufacturing base. But let’s be real—short-term pain can hurt like hell, especially if you’re not positioned right.

There’s some good news for asset owners cloaked in the bad news. One major pain is the cost of construction goods. Tariffs on lumber, steel, aluminum, and gypsum are adding $7,500 to $22,000 per home, per the National Association of Home Builders. It’s not like builders will eat that—they’ll just pass it through to consumers. The NAHB says every $1,000 increase in home prices kicks 106,000 buyers out of the market. First-time homebuyers? They’re getting crushed.

The Hidden Opportunity: Supply Constraints and Cash Flow

Here’s the thing: things that drive up the cost of homes are ultimately good for asset owners. Whether they’re good for the general public is a totally different story.

Higher cost inputs to build will further exacerbate already existing supply constraints. Builders can’t justify new construction if it’s more expensive to build homes while American checkbooks are stretched thin and unwilling to pay more. We’re already in a supply-stretched environment—new development’s been falling off a cliff for years. This won’t help the supply story for the common man, but it’s a goldmine for those of us holding assets.

So what does it mean? I’d bet this will drive more Americans to rent by necessity, further constrain supply, and therefore drive up home prices, property values, and rental income. Real estate should do perfectly in an environment like this because people still need a place to live, and the net effect is hampering new construction. If tariffs also strengthen domestic manufacturing jobs, then in theory, we’d have rising employment coupled with a tough building environment—read: even more rent increases. I’ve got a multifamily property in Seattle that’s seen 10% rent growth since 2022, and I’m not sweating these tariffs one bit.

The negative scenario is stagflation—rising inflation plus a recession. Tariffs could add 2 points to inflation, and if they spark a deep enough downturn (Goldman’s 35% recession odds aren’t nothing), we could see stagnant growth with high prices. That’s a nightmare for most asset classes—stocks tank, bonds get dicey.

But real estate? It’s still a hedge. Rents keep climbing with inflation, and illiquidity keeps you from panicking when the S&P 500 drops another 5%. I’m not fully convinced we’re headed for stagflation—domestic industry might pick up the slack, especially in manufacturing-heavy states—but it’s a risk to watch. If it happens, focus on cash-flowing properties in high-demand markets. They’ll weather the storm better than anything else.

The 2025 Play: How to Win Amidst the Tariff Storm

Here’s your playbook for turning tariffs into a win:

-

Scoop Up Distressed Assets: Some builders are getting squeezed—look for undervalued multifamily or commercial properties in high-demand markets. I’m buying in Seattle right now—tech’s still king, and supply’s tight.

-

Lock in Rates While They’re Low: The 10-year Treasury’s at 4.1%, but if inflation spikes, rates could creep up. Secure fixed-rate debt now on longer-dated contracts—think 10-15 years. If rates drop further, refinance and boost your cash flow.

-

Double Down on Cash Flow: Focus on properties with strong cash flow—multifamily in blue states like Washington should particularly benefit if domestic industry picks up and supply constraints worsen (and it’s a lot worse in blue states). Demand’s not going anywhere, and rents are only going up.

-

Think Long-Term: This is straight out of my upcoming book, The 10 Principles of Timeless Investors - Think Long-Term. Tariffs are a short-term shock, but real estate investors play the long game. Buy, hold, and let the market do its thing.

The Bottom Line: Real Estate Wins (Again)

Tariffs have been shaking up economies for 5,000 years—from Sumerian ports to Trump’s “Liberation Day.” They raise costs, create volatility, and make life hell for the little guy. But they also create opportunities for those who can see the bigger picture. Real estate’s illiquidity keeps us steady, lower rates make us stronger, and history shows us the way. So, while the talking heads on CNBC are panicking, I’m doubling down on real estate. What about you?

If this hits home, subscribe to The Timeless Investor newsletter for more history-backed investing insights.

🎙️ Podcast dropping late April: The Timeless Investor Show

📘 Want to go deeper? Grab my new book: Timeless Wealth: Real Estate Through the Ages.